The Evolution of Taxation in Hardware Stores: An Overview of Invoicing and Fiscal Compliance

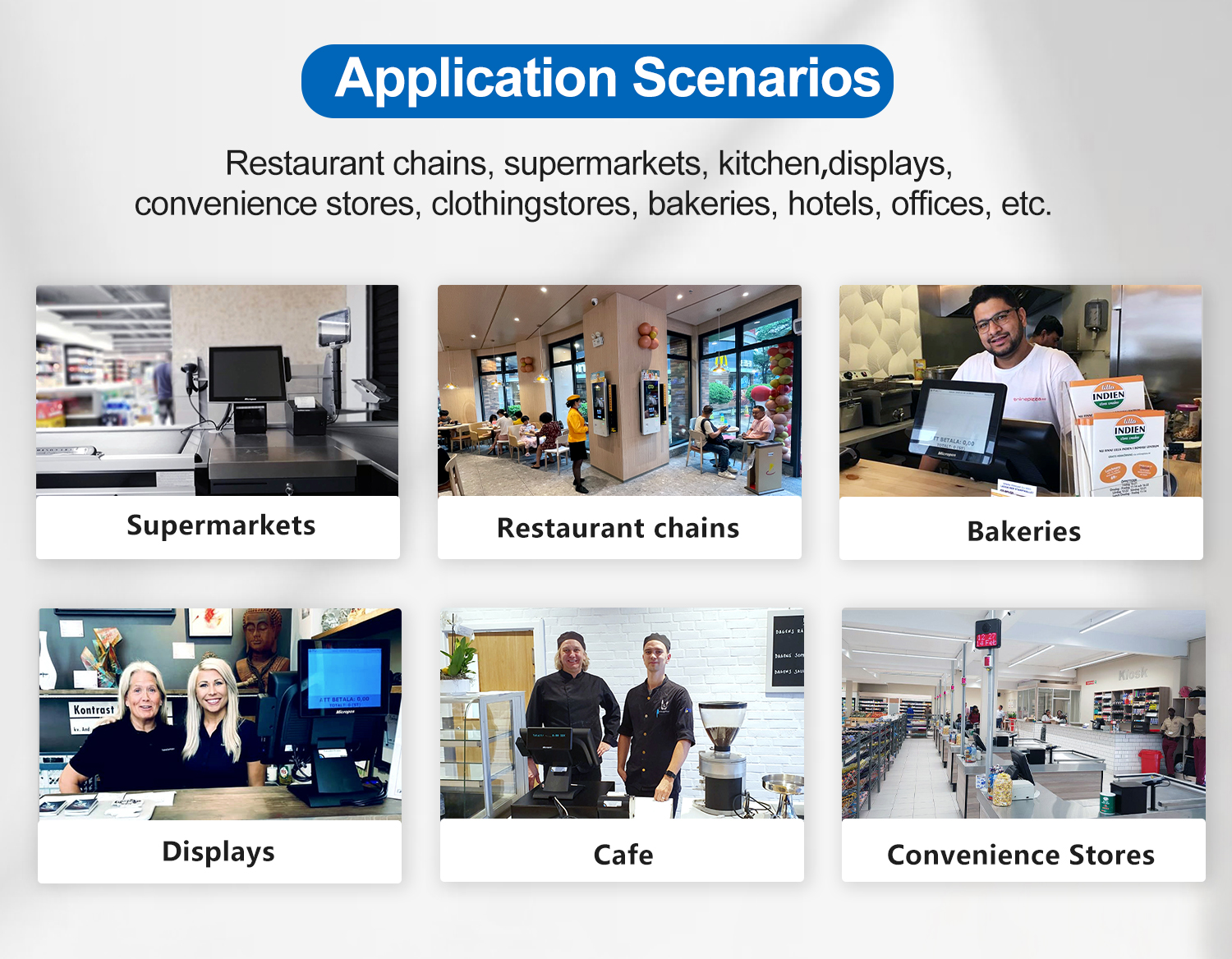

Hardware stores have undergone significant transformations in their approach to taxation over the years. From traditional cash transactions and manual billing, to electronic invoicing systems and automated fiscal compliance processes, the evolution of taxation in hardware stores has been marked by technological advancements and regulatory changes. One notable trend is the increasing adoption of electronic invoicing systems, which enable hardware stores to streamline their billing processes and reduce the risk of error or fraud. These systems also allow for greater accuracy in tracking sales and tax payments, improving overall fiscal compliance. Additionally, some hardware stores are using mobile apps to facilitate invoicing and payment processing on the go. Another important aspect of taxation in hardware stores is compliance with local and state tax laws. With changing tax regulations and increased scrutiny from government agencies, it has become increasingly difficult for hardware stores to ensure they are in compliance. As a result, many are turning to professional services providers, such as accountants and tax experts, to help them navigate complex tax laws and regulations. Overall, the evolution of taxation in hardware stores reflects broader trends in the retail industry, including the increasing importance of technology and data analytics in driving business operations. As hardware stores continue to adapt to changing tax regulations and consumer preferences, it will be important for them to stay up-to-date with the latest developments in this field.

Introduction:

Hardware stores, also known as DIY or home improvement stores, are establishments that sell a wide range of products for household repairs, maintenance, and construction projects. These stores play an essential role in the lives of many consumers who seek practical solutions for their everyday needs. However, running a hardware store is not just about selling products; it also involves various legal and financial obligations, including tax compliance. In this article, we will delve into the topic of invoicing and fiscal compliance for五金店国税开票, exploring the importance of proper documentation and adherence to tax regulations.

The Role of Invoicing in Hardware Store Operations

Invoicing is a crucial aspect of any business transaction, especially for retail businesses such as hardware stores. It serves as a formal record of the sale of goods or services, including the quantity, price, and payment terms. Invoices also help to establish clear expectations between the seller and the buyer, ensuring smooth cash flow and reducing the risk of disputes.

For hardware stores, accurate and timely invoicing is particularly important because it affects several key areas of their operations:

1. Cash Flow Management: Invoices enable merchants to receive payments from customers promptly, which in turn helps them manage their cash flow effectively. A well-organized invoicing system can ensure that payments are received on time, minimizing the need for costly loans or lines of credit.

2. Inventory Management: Regular invoicing allows hardware stores to track their inventory levels more accurately, preventing overstocking or stockouts of critical items. This helps maintain optimal stock levels, reduces waste, and ensures that customers can always find what they need.

3. Customer Satisfaction: Prompt and accurate invoicing demonstrates professionalism and reliability to customers, building trust and loyalty. Satisfied customers are more likely to return, recommend the store to others, and make repeat purchases.

Understanding Fiscal Regulations for Hardware Stores

In order to operate legally and avoid penalties, hardware stores must adhere to various fiscal regulations, including tax laws, sales taxes, and other levies. Some of the most important considerations for these businesses include:

1. Sales Taxes: Many states impose sales taxes on the purchase of goods and services by consumers. Hardware stores are typically responsible for collecting and remitting these taxes to the appropriate taxing authorities. It is essential to understand the sales tax rates and exemptions applicable in your jurisdiction to ensure compliance with tax laws.

2. Invoicing Requirements: To be compliant with tax laws, hardware stores must issue invoices that meet certain criteria, such as including the following information:

a) The date of the invoice

b) The name and address of the merchant

c) The description and quantity of the products or services sold

d) The price per unit or total cost (including taxes)

e) Any applicable discounts or promotions

f) The payment terms and due date

g) The merchant's contact information

h) A unique identifier for each invoice (if required)

3. Record Keeping: Hardware stores must maintain accurate records of all transactions, including invoices, receipts, and bank statements. This information is necessary for auditing purposes, identifying trends, and making informed business decisions. It is also essential for complying with tax regulations and responding to inquiries from tax authorities.

Complying with Fiscal Regulations: Tips for五金店国税开票

To ensure compliance with fiscal regulations and minimize the risk of penalties or fines, hardware stores should consider the following tips:

1. Hire Experienced Accounting Staff: Hiring experienced accountants or bookkeepers can help hardware stores stay compliant with tax laws and manage their finances effectively. They can assist with tasks such as invoicing, accounting software setup, and tax preparation.

2. Implement Effective Invoicing Systems: Investing in an effective invoicing system can save time and reduce errors. Look for software that integrates with your point-of-sale system, tracks inventory levels, and generates automated invoices based on customer purchases. Consider training employees on how to use the system correctly.

Articles related to the knowledge points of this article:

Title: Does the Hardware Store Sell Faucet Mountings?

Title: Does Any Hardware Store Sell Solar Water Heaters?

Title: Is Owning a Hardware Store with a Family of Four Profitable?

Discovering the Treasures of Dongguans Nancheng Sanyuanli Hardware Store